3 Strategies to Increase Patient Financial Literacy

One of the top concerns for healthcare practice managers and billers is getting patients to make payments in a timely manner. There are countless tips and resources with ideas on how to accomplish this, but one method is often missing — improving patient financial literacy.

Understanding medical bills, insurance policies, and payment options can empower patients to take charge of their bills and help them better manage their healthcare costs. For providers, increasing patient financial literacy also streamlines administrative processes and reduces financial stress by shortening revenue cycles.

Below, we’ll dive into how patient financial literacy (or a lack thereof) affects medical practices. Then, we’ll discuss simple solutions that you can start implementing today.

Why Poor Patient Financial Literacy Is a Problem

Healthcare bills can be confusing even for those of us in the industry. Despite this complexity, most patients have never had someone sit down with them to explain what different terms and numbers mean. There’s no high school class that teaches about deductibles and annual limits, after all. This lack of financial literacy can lead to confusion, delayed payments, and even avoidance of necessary care.

A 2022 study found that most healthcare providers rated their patients’ financial literacy as poor. The ripple effects of low patient financial literacy are far-reaching. Medical practices face challenges such as:

- A burden on office administrators due to frequent billing inquiries.

- High rates of unpaid bills and collections.

- Strained patient-provider relationships stemming from financial misunderstandings.

Strategies for Increasing Patient Financial Literacy

While it is not your job to help your patients achieve financial literacy, taking some steps to help patients understand their bills and their responsibilities can pay dividends. These three ways to increase patient financial literacy are a good starting point. Each is broken down into a few subtasks that will help you accomplish your goal.

1. Clear Communication

Effective communication is the cornerstone of financial literacy — and that communication lies on your shoulders. This involves explaining the cost of treatment, payment options, and insurance coverage in simple, accessible language. Meet patients where they’re at and understand that medical billing terms and processes may be unfamiliar or overwhelming to them.

Here are some tips for ensuring your office is providing clear communication with patients:

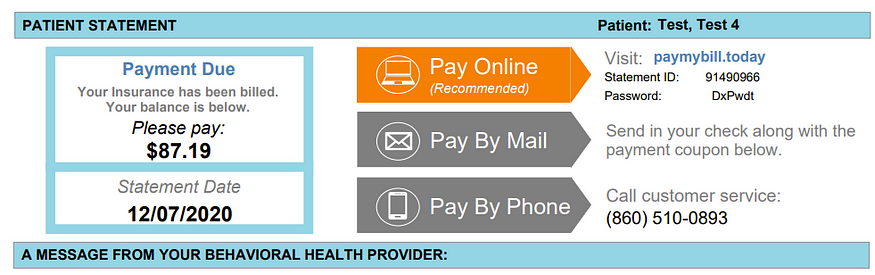

- Simplify billing statements. Use plain language and avoid medical jargon; when jargon is necessary, provide an explanation on the bill itself. Highlight key information such as due dates, amounts owed, and payment options. Make it easy for patients to understand what they owe and why.

- Explain insurance plan benefits. Many patients may not fully understand their insurance coverage, leading to surprise expenses. Provide a breakdown of their plan benefits, including deductibles, copays, and coinsurance percentages. This information can help patients make more informed decisions about their healthcare.

- Offer explanatory resources. Provide brochures and FAQs that explain common billing terms and processes. Offer these to new patients so they can familiarize themselves with the billing process before any medical services are rendered.

- Provide transparent pricing. Above all else, providing transparent pricing is crucial. Be upfront about the cost of treatment and any potential additional fees to avoid misunderstandings down the road.

2. Flexible Technology

Technology offers powerful tools to enhance patient financial literacy, but it also makes it easier for all of your patients to take care of their bills in a timely manner — and in a way that’s convenient for them. This is an investment that will benefit your entire practice, and your staff as well. Some technology-based solutions that can improve patient financial literacy include:

- Online patient portals. These portals provide patients with secure access to their medical records, test results, and eStatements. They also allow for easy online bill payments, the ability to ask questions, and even request payment plans.

- Electronic statements and reminders. Switching to electronic statements reduces paper waste, saves time and money, and ensures bills are delivered promptly. Automated reminders can also be sent via email or text message to ensure patients don’t miss payment due dates.

- Mobile apps. Develop or utilize apps that offer bill tracking, budget planning, and payment reminders. Many younger patients may not use computers or email regularly, making mobile options increasingly important.

- Interactive tools. Offer calculators and estimators on your website to help patients anticipate costs and plan for payments. These tools can help patients understand the impact of their insurance coverage on their overall healthcare costs as well.

3. Education Programs

Finally, you may want to offer education programs for your patients, depending on their baseline financial literacy and your medical specialization. While this kind of program may not make sense for a primary care doctor or a pediatrician’s office, it can be critical for specialists like oncologists or cosmetic surgeons.

- Workshops and seminars. Host regular workshops that cover topics like understanding insurance plans, managing medical bills, and financial planning for healthcare. These events can be great opportunities to educate patients and address any concerns or questions they may have.

- One-on-one counseling. Offer personalized financial counseling sessions to address individual patient concerns and questions. For example, a financial counselor may help patients understand how a health savings account works and what a payment plan may look like over time.

- Online courses. Develop online courses focused on healthcare finance topics that patients can access at their convenience. This works well because once you’ve invested in developing the course, there is practically no overhead in maintaining it for new patients.

Benefits of Improved Patient Financial Literacy

Implementing these programs can help your patients and your practice in the following ways:

- Reduced financial stress for patients. Clarity around medical expenses helps alleviate financial anxiety and makes patients feel empowered.

- More time for high-level tasks. Fewer billing inquiries and disputes — and less time chasing after patients for payments — frees up valuable administrative time.

- Improved cash flow. Timely payments will enhance your practice’s financial stability.

- Enhanced patient relationships. Transparent financial communication builds trust and loyalty between patient and provider.

Final Thoughts

Improving patient financial literacy is a win-win for patients and healthcare providers. By prioritizing clear communication, leveraging technology, and offering educational resources, medical billers and practice managers can foster more financial literacy in their patients.

MailMyStatements makes it easy to provide clear communication about billing to your patients through our digital billing system. Get in touch with us today to learn more.

Comments

Post a Comment